Switching Car Insurance Doesn’t Mean Starting Over

Switch Car Insurance Providers without fear of losing your discounts. Many drivers stay with the same car insurance company for years not because they’re satisfied, but because they worry about losing valuable savings. Loyalty discounts, safe-driver rewards, bundling perks, and accident-free incentives can feel like golden handcuffs.

Here’s the truth in 2026: switching car insurance providers is easier than ever and you can often keep most (or even all) of your discounts if you do it correctly.

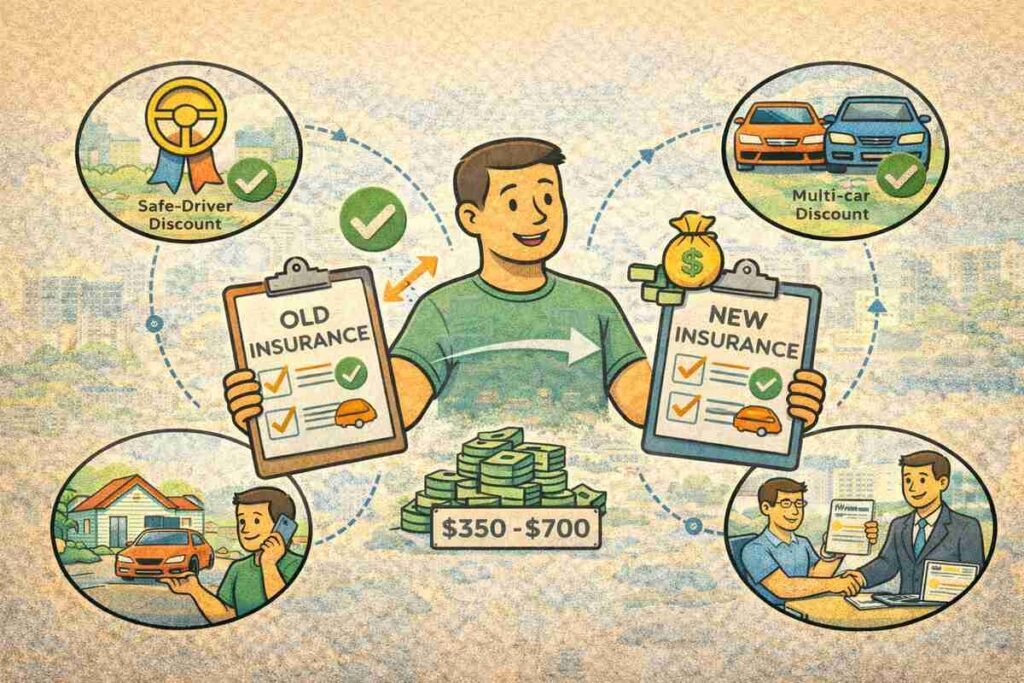

According to a 2025 Forbes Advisor study, drivers who shop around and switch insurers save an average of $350–$700 per year, even after accounting for lost loyalty perks. At the same time, insurers increasingly offer better incentives to new customers than to long-term ones.

This complete guide walks you through how to switch car insurance step by step, explains how discounts really work, which ones transfer, which don’t, and how to protect your savings during the transition.

Why Switching Car Insurance Often Makes Financial Sense

Insurance pricing isn’t static. Companies constantly adjust rates based on losses, inflation, and market strategy.

Common Reasons Drivers Switch

- Premiums increase at renewal with no explanation

- Life changes (move, new car, marriage)

- Better digital tools or claims experience elsewhere

- Bundling opportunities

- Inflation‑driven rate hikes

Example: A driver with a clean record sees a 15% renewal increase and saves $420 by switching.

Reference: The Insurance Information Institute confirms that loyalty alone rarely guarantees the best rate.

Takeaway: Staying put doesn’t always mean saving money.

Understanding Car Insurance Discounts (Before You Switch)

Not all discounts work the same way. Some are portable. Others are insurer‑specific.

Common Discount Categories

- Safe‑driver discounts

- Accident‑free discounts

- Multi‑policy (bundle) discounts

- Low‑mileage discounts

- Vehicle safety discounts

- Telematics / usage‑based discounts

Important: Discounts aren’t benefits you “own” they’re pricing adjustments based on risk factors.

Which Discounts You Can Usually Keep When Switching

The good news: many discounts are based on you, not your insurer.

Transfer‑Friendly Discounts

1. Safe‑Driver & Accident‑Free Discounts

- Based on driving history, not loyalty

- Verifiable through motor vehicle records (MVR)

Example: A driver accident‑free for 7 years qualifies for top‑tier safe‑driver rates at most insurers.

2. Good Credit Discounts

- Credit‑based insurance scores carry over

- Widely used in pricing models

Note: Laws vary by state, but where allowed, credit history remains influential.

3. Vehicle Safety & Anti‑Theft Discounts

- Based on your car’s features

- VIN verification transfers automatically

Example: Anti‑lock brakes, airbags, alarms, and tracking systems still qualify.

4. Low‑Mileage Discounts

- Verified through self‑reporting or telematics

- Especially valuable for remote workers

Discounts You Might Lose (and How to Replace Them)

Some discounts are tied directly to your current insurer.

Less‑Transferable Discounts

1. Loyalty Discounts

- Typically reset when you leave

- Often smaller than advertised

Reality check: Loyalty discounts are often outweighed by new‑customer pricing.

2. Claims‑Free With Same Insurer Bonuses

- Some insurers reward long internal claim‑free streaks

Solution: Ask the new insurer if accident‑free history can substitute.

3. Telematics Program Discounts

- Usage‑based discounts usually don’t transfer

Workaround: Enroll in the new insurer’s telematics program immediately.

Step‑by‑Step: How to Switch Car Insurance the Right Way

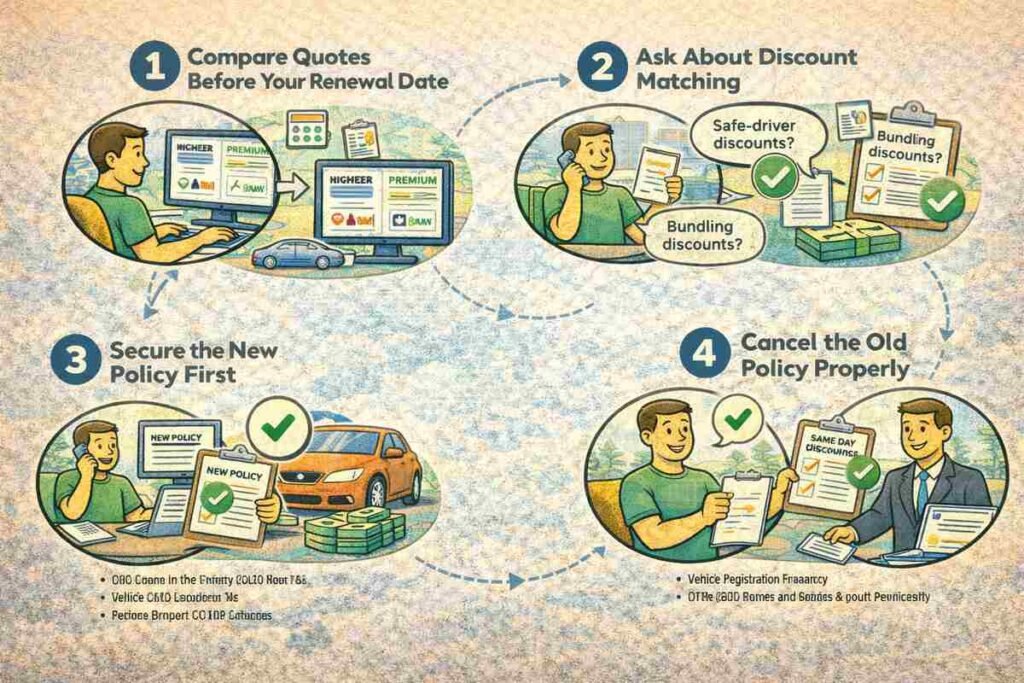

Step 1: Compare Quotes Before Your Renewal Date

Start shopping 2–4 weeks before renewal.

What to compare:

- Same coverage limits

- Same deductibles

- Same drivers and vehicles

Tip: Comparing unequal coverage creates false savings.

Step 2: Ask About Discount Matching

Many insurers will manually apply discounts if you ask.

Questions to ask:

- “Do you match safe‑driver or accident‑free history?”

- “Can you review my current discounts?”

- “Are there equivalent bundle or low‑mileage discounts?”

Takeaway: Discounts aren’t automatic—advocacy matters.

Step 3: Secure the New Policy First

Never cancel your old policy before the new one is active.

Why This Matters

- Avoid coverage gaps

- Prevent license or registration issues

- Protect your continuous‑coverage record

Step 4: Cancel the Old Policy Properly

Once the new policy is active:

- Contact your old insurer directly

- Request cancellation effective the same day

- Ask about prorated refunds

Tip: Get written confirmation.

Step 5: Update Proof of Insurance Everywhere

Remember to update:

- Vehicle registration

- Financing or leasing company

- Parking permits

- Employer records (if required)

How to Preserve Bundling Discounts When Switching

Bundling often provides the biggest savings but it requires planning.

Smart Bundling Strategies

- Get auto + home quotes together

- Compare bundle vs separate pricing

- Ensure coverage quality stays consistent

Example: A driver saves more by switching both auto and renters insurance together.

Will Switching Hurt Your Insurance History?

Short answer: No, if done correctly.

What Insurers Care About

- Continuous coverage

- Claims history

- Driving record

Switching insurers does not reset your driving history.

Real‑Life Example: Keeping Discounts While Switching

After a 12% renewal increase, Maya compared quotes.

By switching:

- She kept safe‑driver and low‑mileage discounts

- Replaced loyalty discounts with a new‑customer incentive

- Enrolled in a new telematics program

Result: $510 saved annually.

Lesson: Discounts change but savings can grow.

Common Mistakes to Avoid When Switching

- Cancelling before securing new coverage

- Comparing different coverage levels

- Forgetting to ask about discounts

- Assuming loyalty equals savings

- Ignoring deductible changes

Comparison Table: Staying vs Switching Insurers

| Factor | Staying Put | Switching |

|---|---|---|

| Loyalty discount | Small | Lost but replaced |

| New‑customer pricing | No | Yes |

| Rate negotiation | Limited | Strong |

| Savings potential | Low | High |

| Control | Passive | Active |

Frequently Asked Questions

1. How often should I switch car insurance?

Every 1–2 years, or after major life changes.

2. Will switching raise my rates later?

No, rates are based on risk, not loyalty alone.

3. Can I switch mid‑policy?

Yes, most insurers refund unused premiums.

4. Is it bad to switch frequently?

No, as long as coverage is continuous.

5. Should I tell my old insurer why I’m leaving?

Optional, but feedback can help.

Final Thoughts

Switching car insurance providers doesn’t mean sacrificing discounts, it means understanding how discounts really work. With smart timing, careful comparisons, and a willingness to ask questions, you can protect your perks while lowering your premium.

In today’s inflation‑driven market, the most expensive insurance strategy is blind loyalty.

If this guide helped you feel confident about switching insurers, share it or explore more smart auto‑insurance tips on our blog.