The Cars Are Smarter, Cleaner and Insurance Is Changing Fast

Electric and connected vehicles are no longer niche options for early adopters. By 2026, they are rapidly becoming the default choice for new car buyers. With advanced driver assistance systems (ADAS), real-time connectivity, over-the-air software updates, and electric drivetrains, these vehicles are fundamentally different from traditional gas-powered cars.

And because the vehicles have changed, insurance has had to evolve too.

According to a 2025 Harvard Business Review mobility report, over 55% of new vehicles sold globally now include advanced connectivity features, while electric vehicle (EV) adoption continues to accelerate. These changes are forcing insurers to rethink pricing, coverage, claims handling, and risk assessment.

This guide explains what’s new in 2026 when it comes to insuring electric and connected vehicles, how premiums are calculated, what coverage matters most, and how drivers can benefit from the latest insurance innovations.

Why Electric And Connected Vehicles Require Different Insurance Models

Traditional insurance models were built for mechanical cars with limited data. Modern vehicles operate more like computers on wheels.

Key Differences Insurers Must Account For

- High-voltage battery systems

- Expensive sensors and cameras

- Software-driven safety features

- Real-time data transmission

- Advanced repair requirements

Example: A minor collision that once required a bumper replacement may now involve recalibrating sensors and cameras, significantly increasing repair costs.

Reference: The Insurance Information Institute confirms that technology complexity is one of the biggest drivers of insurance innovation.

Takeaway: Smarter cars require smarter insurance.

1. How Electric Vehicles Affect Insurance Premiums in 2026

EVs are cheaper to fuel and maintain, but insurance tells a more complex story.

Factors That Can Increase EV Premiums

- High battery replacement costs

- Specialized repair facilities

- Limited availability of parts

- Advanced electronics damage risk

Factors That Can Lower EV Premiums

- Fewer mechanical failures

- Lower accident rates due to ADAS

- Eco-driver discounts

- Lower annual mileage for many EV owners

Example: Two compact vehicles with similar price tags may have very different premiums if one is electric and sensor-heavy.

Research Insight: Forbes Advisor reports that EV insurance can be slightly higher upfront, but discounts often offset costs over time.

Takeaway: EV premiums depend on technology, not just vehicle price.

2. Battery Coverage: One of the Biggest 2026 Insurance Updates

The battery is the most expensive component of an EV.

What’s New in 2026

- Clearer battery coverage definitions

- Improved battery damage assessments

- Expanded comprehensive coverage options

- Better coordination with manufacturer warranties

What Insurance Typically Covers

- Battery damage from collisions

- Fire or flood-related battery loss

- Theft-related damage

What’s Usually Excluded

- Normal degradation

- Manufacturer defects (covered by warranty)

Example: Flood damage that affects an EV battery is now more consistently covered under comprehensive policies.

Takeaway: Understanding battery coverage is critical for EV owners.

3. Connected Car Data & Usage-Based Insurance

Connected vehicles generate valuable driving data and insurers are using it.

How Data Is Used

- Mileage tracking

- Speeding patterns

- Hard braking events

- Time-of-day driving

Benefits for Drivers

- Personalized pricing

- Faster claims processing

- Safe-driver discounts

- Transparent driving feedback

Example: A connected EV owner enrolled in a telematics program reduced their premium by 19% after six months of safe driving.

Reference: Forbes Advisor’s UBI Guide explains how telematics rewards responsible drivers.

Takeaway: Data-driven insurance benefits careful drivers the most.

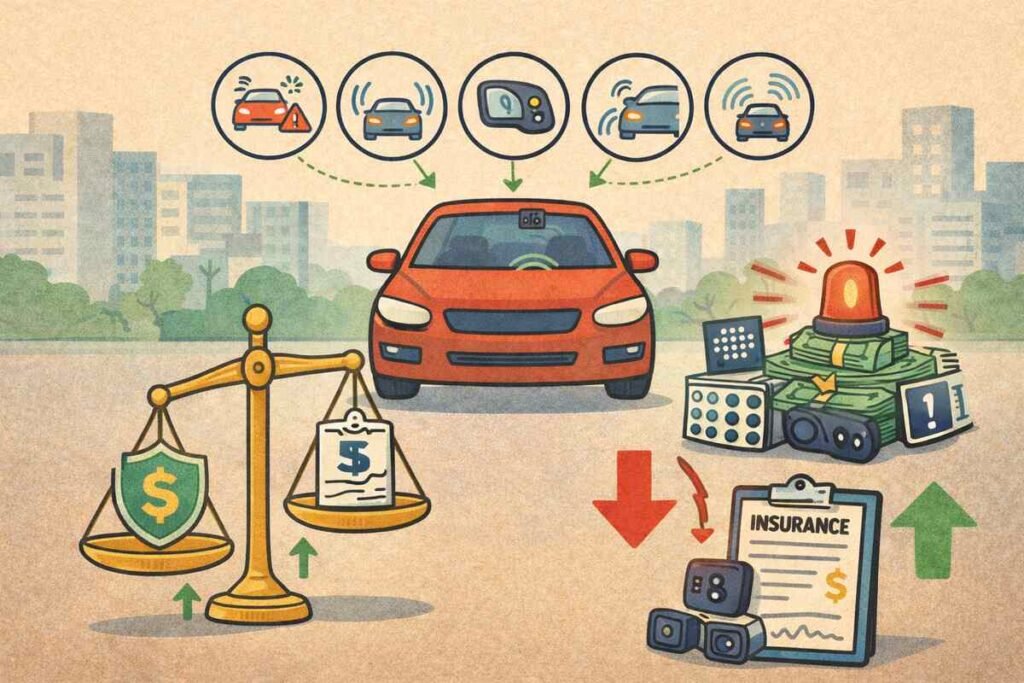

4. ADAS Systems: Safety Discounts vs Repair Costs

Advanced Driver Assistance Systems reduce accidents, but increase repair complexity.

Common ADAS Features

- Automatic emergency braking

- Lane-keeping assistance

- Blind-spot monitoring

- Adaptive cruise control

Insurance Impact

- Fewer claims overall

- Higher cost per claim when accidents occur

Example: A windshield replacement that includes camera recalibration may cost double compared to older vehicles.

Reference: The National Highway Traffic Safety Administration highlights ADAS as a major safety advancement.

Takeaway: Safety tech saves lives, but increases repair costs.

5. Cybersecurity Coverage for Connected Vehicles

Cyber risk is now a real insurance concern.

What’s New in 2026

- Optional cyber protection endorsements

- Coverage for data breaches related to vehicle systems

- Protection against unauthorized remote access

Example: If a connected vehicle system is compromised and causes damage, cyber endorsements may help cover associated losses.

Reference: The National Highway Traffic Safety Administration emphasizes cybersecurity as a growing priority.

Takeaway: Digital threats now affect physical vehicles.

6. Charging Equipment & Home Infrastructure Coverage

EV ownership extends beyond the car itself.

Coverage Considerations

- Home charging stations

- Damage to charging cables

- Electrical upgrades related to charging

Some insurers now offer optional riders to protect charging equipment.

Example: A storm damages a home charging station, coverage may apply under auto or homeowners insurance depending on the policy.

Takeaway: Charging gear deserves insurance attention too.

7. Claims Handling for Electric And Connected Vehicles

Claims are becoming more digital and data-driven.

What’s Improved in 2026

- Automated crash detection

- Digital damage assessment

- Faster approvals

- AI-assisted claims triage

Example: Vehicle sensors automatically transmit crash data, speeding up claim processing.

Takeaway: Smarter cars lead to faster claims.

Real-Life Example: A Driver Benefiting From Modern Coverage

When Alex’s connected EV was damaged in a minor collision, onboard sensors sent data to the insurer instantly. Repairs were approved within 48 hours, and battery diagnostics confirmed no long-term damage.

Lesson: Technology improves the insurance experience, when coverage is up to date.

Comparison Table: Traditional vs EV & Connected Vehicle Insurance

| Feature | Traditional Vehicles | EV & Connected Vehicles |

|---|---|---|

| Pricing Model | Demographics-based | Data & tech-based |

| Repair Costs | Lower | Higher |

| Safety Discounts | Limited | Extensive |

| Claims Speed | Moderate | Faster |

| Cyber Coverage | Rare | Increasing |

Frequently Asked Questions for 2026 Drivers

1. Are EVs more expensive to insure?

Sometimes, but discounts and lower mileage often balance costs.

2. Does insurance cover battery replacement?

Only for covered damage, not wear and tear.

3. Is data sharing mandatory?

No, telematics programs are typically optional.

4. Do connected cars reduce premiums?

They can, especially with safe driving behavior.

5. Should EV owners review policies more often?

Yes, technology changes quickly.

Final Thoughts

Insuring electric and connected vehicles in 2026 requires a fresh approach. With advanced technology, real-time data, and evolving risks, drivers benefit most when their coverage reflects how modern vehicles actually operate.

Staying informed, reviewing coverage regularly, and using digital tools ensures you’re protected and not overpaying.

If this guide helped you understand modern auto insurance trends, share it or explore more future-focused coverage insights on our blog.