Introduction

Car Insurance Renewal Tips can save drivers far more money than most realize. Car insurance renewal is one of those recurring expenses many drivers accept without question. A notice arrives, premiums increase slightly, and policies are renewed automatically, often under the assumption that there are no better options. Over time, this habit can cost hundreds or even thousands of dollars.

In reality, insurance pricing is highly dynamic. Rates change based on risk models, market competition, personal driving behavior, and even broader economic conditions. According to analysis from the Insurance Information Institute, many drivers overpay simply because they don’t reassess their coverage at renewal.

The good news is that renewal time is the best opportunity to cut costs, often without sacrificing coverage. This article outlines nine powerful, evidence-backed strategies to slash car insurance costs during renewal while maintaining strong financial protection.

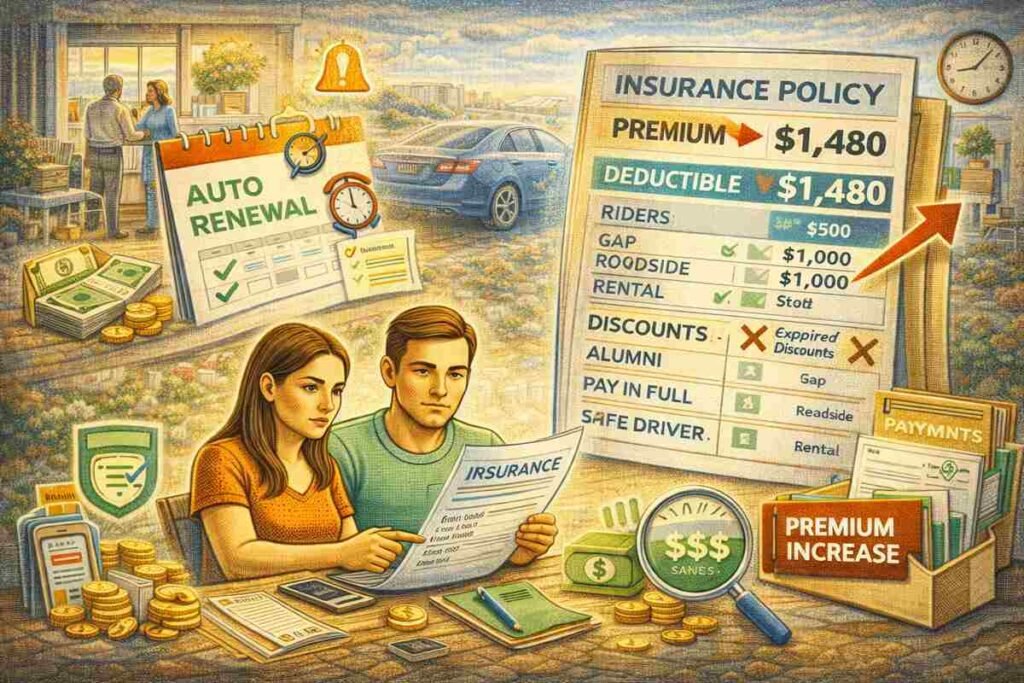

1. Never Auto-Renew Without Reviewing Your Policy

Automatic renewal is convenient, but expensive.

Insurance companies rely on customer inertia. Studies cited by Consumer Reports show that loyal customers often pay higher premiums over time than new customers with similar risk profiles.

Before renewing, review:

- Your current premium and coverage limits

- Changes in deductibles

- Added riders you may no longer need

- Discounts that may have expired

A 15-minute review can uncover unnecessary costs that quietly compound year after year.

2. Shop Around, Even If You Like Your Insurer

Price comparison is one of the most effective cost-cutting tools.

Each insurer uses proprietary risk algorithms, meaning the same driver can receive vastly different quotes. Research from ValuePenguin shows that drivers who compare quotes every renewal cycle save an average of 20–30%.

Best practice:

- Get quotes from at least 3–5 insurers

- Compare equal coverage, not just price

- Check both large providers and regional insurers

Even if you stay with your current insurer, competitor quotes give you leverage for negotiation.

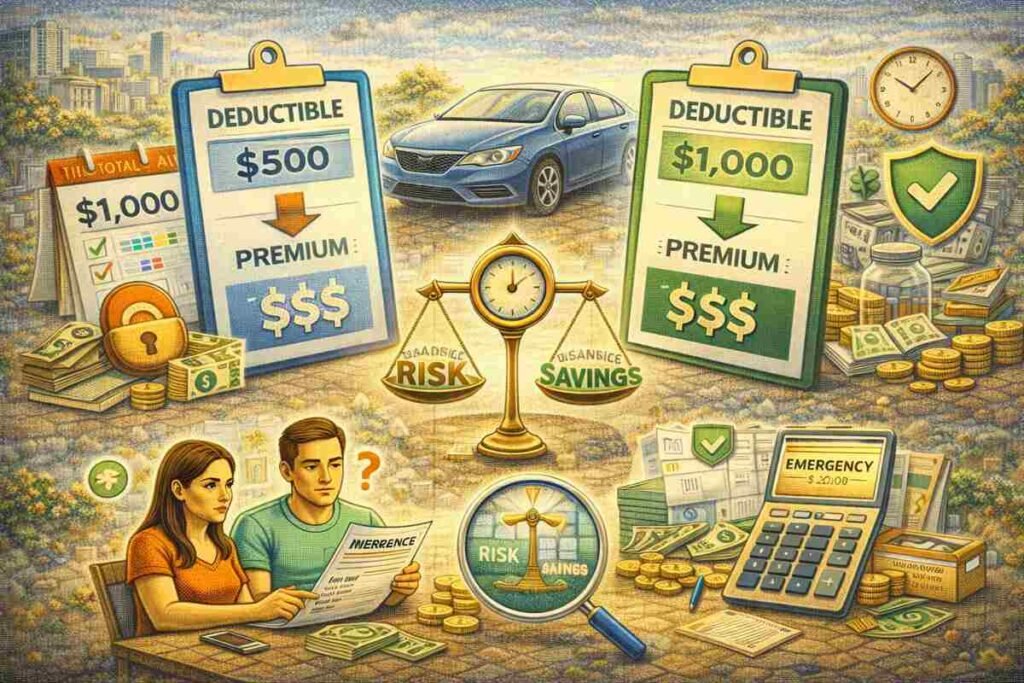

3. Increase Your Deductible Strategically

Raising your deductible lowers your premium, but it must be done thoughtfully.

According to data published by NerdWallet, increasing a deductible from $500 to $1,000 can reduce collision and comprehensive premiums by up to 25%.

However, ensure:

- You can comfortably afford the higher deductible

- The premium savings outweigh the added risk

- You maintain sufficient emergency savings

For financially stable drivers, higher deductibles are one of the fastest ways to reduce annual costs.

4. Reassess Coverage Based on Vehicle Value

Over-insuring an aging vehicle is a common mistake.

If your car’s market value is low, paying for full collision and comprehensive coverage may not be cost-effective. Guidance from Kelley Blue Book suggests reconsidering full coverage when annual premiums exceed 10% of the vehicle’s value.

Consider dropping optional coverage if:

- Your car is fully paid off

- Repair or replacement costs are low

- You can absorb potential losses

This single adjustment can result in significant long-term savings.

5. Leverage Usage-Based and Telematics Programs

Modern insurers increasingly offer usage-based insurance (UBI) programs that track driving behavior via apps or devices.

Safe drivers can benefit substantially. According to Progressive, participants may save up to 30% based on driving habits such as mileage, braking, and time of day.

UBI programs are ideal for:

- Low-mileage drivers

- Remote or hybrid workers

- Cautious, defensive drivers

While not suitable for everyone, telematics can dramatically lower costs for the right profiles.

6. Maximize Every Available Discount

Many drivers qualify for discounts they never claim.

Common but overlooked discounts include:

- Bundling home and auto insurance

- Defensive driving or safety courses

- Low annual mileage

- Anti-theft and safety features

- Paperless billing and auto-pay

Discount lists vary by insurer, so review options directly on provider websites or through brokers like The Zebra.

Asking directly about discounts can unlock savings your insurer won’t automatically apply.

7. Improve Your Credit-Based Insurance Score

In most U.S. states, insurers use credit-based insurance scores to assess risk. Research summarized by the Federal Trade Commission confirms a strong correlation between credit behavior and insurance claims.

Improving your credit profile can reduce premiums over time.

Efficiency tips:

- Pay bills on time

- Reduce credit utilization

- Avoid unnecessary credit inquiries

- Review credit reports for errors

Better credit doesn’t just lower borrowing costs, it can also lower insurance premiums.

8. Adjust Coverage After Life Changes

Life changes often reduce risk, but policies are rarely updated automatically.

You may qualify for lower rates if you:

- Work from home

- Retire or drive less

- Move to a safer neighborhood

- Add a more experienced driver to the policy

According to Allstate, mileage reductions alone can significantly lower premiums. Always notify your insurer of relevant changes before renewal.

9. Negotiate With Your Current Insurer

Negotiation works, especially at renewal.

Insurers prefer retaining customers over acquiring new ones. If you’ve received lower quotes elsewhere, present them directly. Guidance from Forbes Advisor confirms that retention departments often have flexibility to adjust pricing.

Negotiation tips:

- Mention competitor quotes

- Highlight your claims-free history

- Ask about loyalty or retention discounts

Even modest negotiations can result in meaningful savings.

Common Renewal Mistakes to Avoid

Drivers often overpay because they:

- Renew automatically without review

- Focus only on premium, not coverage value

- Ignore deductible optimization

- Fail to report reduced mileage

Avoiding these mistakes is just as important as applying cost-saving tactics.

Final Thoughts

Car insurance renewal is not a formality, it’s a financial decision with real consequences. By applying these nine powerful strategies, drivers can reduce premiums while maintaining appropriate coverage.

The most effective approach combines awareness, comparison, and proactive negotiation. A small investment of time at renewal can deliver substantial long-term savings.

In insurance, informed drivers always pay less.