Introduction

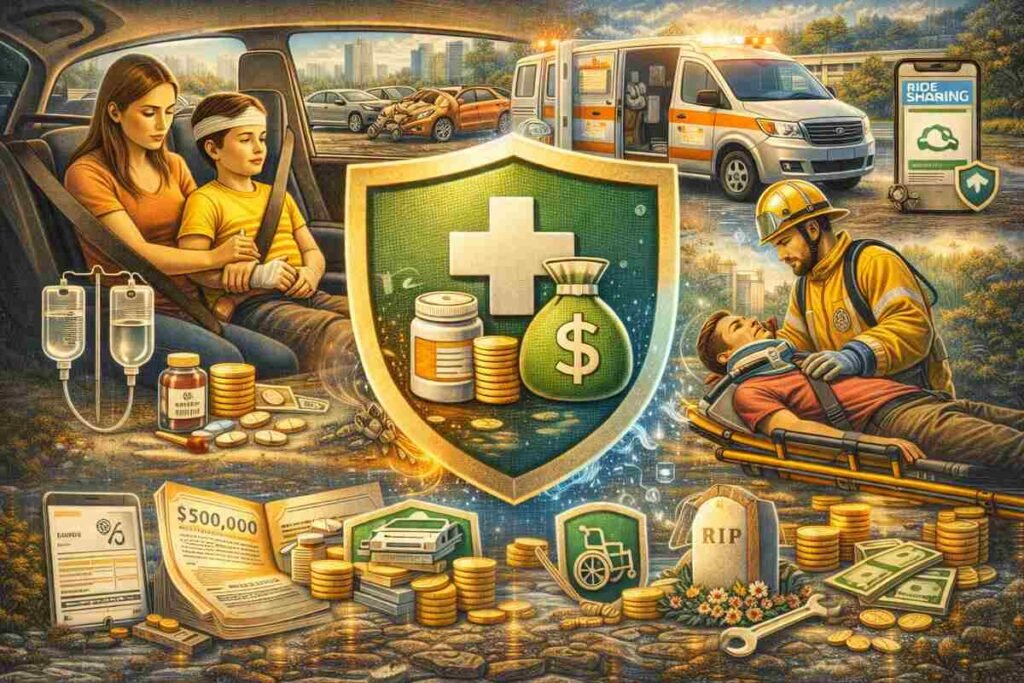

Car Insurance Policy Add-Ons often determine the real value of coverage beyond the base premium. While many drivers focus primarily on price, these optional coverages, also known as riders or endorsements are designed to address specific risks that standard policies may not fully cover.

According to the Insurance Information Institute, many drivers are either underinsured or paying for protection that doesn’t align with their real-world needs. The right add-ons can significantly improve financial protection, reduce out-of-pocket expenses, and provide peace of mind, often for a relatively small increase in premium.

This article explores nine smart and worthwhile car insurance add-ons, explaining what they cover, who should consider them, and when they deliver genuine value.

1. Roadside Assistance Coverage

Roadside assistance is one of the most widely used insurance add-ons and for good reason.

This coverage typically includes towing, battery jump-starts, flat tire changes, fuel delivery, and lockout services. Data cited by AAA shows that breakdown-related incidents are among the most common reasons drivers require emergency help.

Best for:

- Daily commuters

- Older vehicles

- Drivers without manufacturer roadside coverage

Compared to paying per incident, roadside assistance add-ons often pay for themselves after a single use.

2. Zero Depreciation (New Car Replacement) Cover

Standard insurance policies factor depreciation into claim payouts, reducing reimbursement over time. Zero depreciation add-ons eliminate this reduction.

Guidance from Policygenius explains that without this add-on, parts such as tires, batteries, and plastic components are reimbursed at depreciated values.

Why it’s valuable:

- Higher claim payouts

- Lower out-of-pocket repair costs

- Ideal for new or high-value vehicles

This add-on is particularly powerful during the first 3–5 years of vehicle ownership.

3. Engine and Gearbox Protection

Engine and transmission repairs are among the most expensive automotive fixes.

Standard policies usually exclude damage caused by oil leaks, water ingress, or mechanical failure. Engine protection add-ons close this gap. According to analysis by Forbes Advisor, engine-related claims are a major cost driver for vehicle owners.

Best for:

- Flood-prone regions

- Luxury or performance vehicles

- Drivers planning long-term ownership

This add-on can save thousands in unexpected repair bills.

4. Return to Invoice (RTI) Coverage

Return to Invoice coverage ensures that if your car is totaled or stolen, you receive the original invoice value rather than the depreciated market value.

Automotive valuation resources like Kelley Blue Book show that vehicles lose a significant portion of their value in the first few years.

RTI typically covers:

- Original purchase price

- Registration fees

- Road tax (varies by policy)

RTI is especially useful for new cars and financed vehicles.

5. Personal Accident Cover for Passengers

While base policies often include limited personal accident coverage for the driver, passenger coverage is frequently optional.

This add-on provides financial compensation for medical expenses, disability, or death resulting from an accident. Insights from the National Safety Council highlight the financial impact of injury-related incidents on families.

Who should consider it:

- Families

- Ride-sharing drivers

- Regular carpoolers

Passenger accident coverage ensures broader protection beyond the driver alone.

6. Rental Car Reimbursement

If your vehicle is in the shop after an accident, rental car reimbursement covers the cost of a temporary replacement.

According to Consumer Reports, repair delays have increased due to supply chain constraints, leaving drivers without transportation for extended periods.

Why it matters:

- Maintains mobility during repairs

- Prevents unexpected rental expenses

- Particularly useful for single-vehicle households

This add-on adds convenience and financial predictability.

7. Key Replacement Coverage

Modern car keys and key fobs are expensive to replace due to embedded electronics and security coding.

Automotive cost breakdowns from Edmunds indicate replacement costs can range from hundreds to over a thousand dollars.

Key replacement coverage includes:

- Lost or stolen keys

- Reprogramming costs

- Lock replacement (policy-dependent)

This is a low-cost add-on with high real-world value.

8. Consumables Cover

Consumables such as engine oil, coolant, brake fluid, and nuts and bolts are often excluded from standard claims.

According to repair industry insights from AutoCare Association, these costs add up quickly during accident repairs.

Consumables cover helps by:

- Reducing small but frequent out-of-pocket expenses

- Ensuring more complete claim settlements

This add-on is especially beneficial for frequent drivers.

9. No-Claim Bonus (NCB) Protection

No-claim bonuses reward safe driving but can be lost after a single claim.

NCB protection preserves your accumulated discount even after a claim, as explained by resources like Investopedia.

Why NCB protection matters:

- Prevents premium spikes after minor claims

- Rewards long-term safe drivers

- Stabilizes insurance costs

This add-on is ideal for experienced, low-risk drivers.

How to Choose the Right Add-Ons

Not all add-ons are necessary for every driver. Smart selection depends on:

- Vehicle age and value

- Driving frequency

- Local risk factors

- Financial risk tolerance

Avoid stacking add-ons without evaluating real-world benefit.

Final Thoughts

Car insurance add-ons are not upsells, they are tools. When chosen strategically, they enhance protection, reduce financial shocks, and improve overall policy value.

By understanding these nine smart and worthwhile extras, drivers can customize coverage that reflects how they actually use their vehicles, not just how insurers package policies.

In the long run, the right add-ons don’t increase insurance costs, they control them.