Understanding Car Insurance FAQs: Your Essential Guide

Car Insurance FAQs help drivers understand essential aspects of their policies, including coverage, costs, and legal requirements. This guide answers the most commonly asked questions about car insurance to ensure you make informed decisions.

What is Car Insurance FAQs?

Car Insurance FAQs provide insights into car insurance, a contract between you and an insurer that offers financial protection in cases of accidents, theft, or damages. By paying a regular premium, you ensure coverage according to your policy terms.

Why are Car Insurance FAQs Important?

Car Insurance FAQs are crucial because they:

- Offer clarity on different policy types.

- Explain financial protection against accidents.

- Help drivers comply with legal requirements.

- Provide insights into cost-saving strategies.

Without understanding Car Insurance FAQs, drivers may struggle with selecting the right coverage or dealing with claims efficiently.

What Are the Different Types of Car Insurance Coverage?

Car Insurance FAQs commonly address different coverage options, including:

1. Liability Insurance

- Covers bodily injuries and property damage if you are at fault in an accident.

- Required in most states.

2. Collision Coverage

- Pays for damages to your car caused by a collision with another vehicle or object.

3. Comprehensive Coverage

- Covers damages not caused by a collision, such as theft, vandalism, or natural disasters.

4. Personal Injury Protection (PIP) / Medical Payments Coverage

- Covers medical expenses for you and your passengers after an accident.

5. Uninsured/Underinsured Motorist Coverage

- Protects you if you’re involved in an accident with a driver who lacks sufficient insurance.

How Much Car Insurance Do I Need?

Car Insurance FAQs emphasize that coverage needs depend on factors such as:

- State requirements: Each state has minimum liability coverage requirements.

- Your vehicle’s value: Expensive cars require higher coverage.

- Your financial situation: More coverage means better protection.

- Loan or lease requirements: Lenders may require full coverage.

How Are Car Insurance Rates Determined?

Car Insurance FAQs highlight the key factors affecting premiums:

- Driving history: Accidents and violations increase rates.

- Age and gender: Younger drivers often pay higher premiums.

- Vehicle type: Expensive or high-performance cars cost more to insure.

- Location: Urban areas with higher accident rates lead to increased premiums.

- Credit score: Insurers use credit scores in some states to determine rates.

To get the best rates, maintain a clean driving record, choose a car with good safety ratings, and compare quotes from different insurers.

What is a Deductible in Car Insurance FAQs?

A deductible is the amount you pay out of pocket before your insurance covers a claim. Choosing a higher deductible can lower your monthly premium but may require you to pay more in case of an accident.

How Can I Lower My Car Insurance Premiums?

Car Insurance FAQs suggest the following strategies to reduce costs:

- Compare quotes: Shop around for the best rates.

- Bundle policies: Combine auto and home insurance for discounts.

- Maintain a good driving record: Avoid accidents and violations.

- Increase your deductible: Opting for a higher deductible can lower premiums.

- Ask about discounts: Many insurers offer discounts for safe driving, multiple vehicles, and good student records.

- Drive less: Low-mileage drivers often qualify for lower rates.

Does Car Insurance FAQs Cover Rental Cars?

Many car insurance policies extend coverage to rental cars. If you have full coverage, your rental vehicle may be protected. However, if you only have liability insurance, you may need additional rental car insurance.

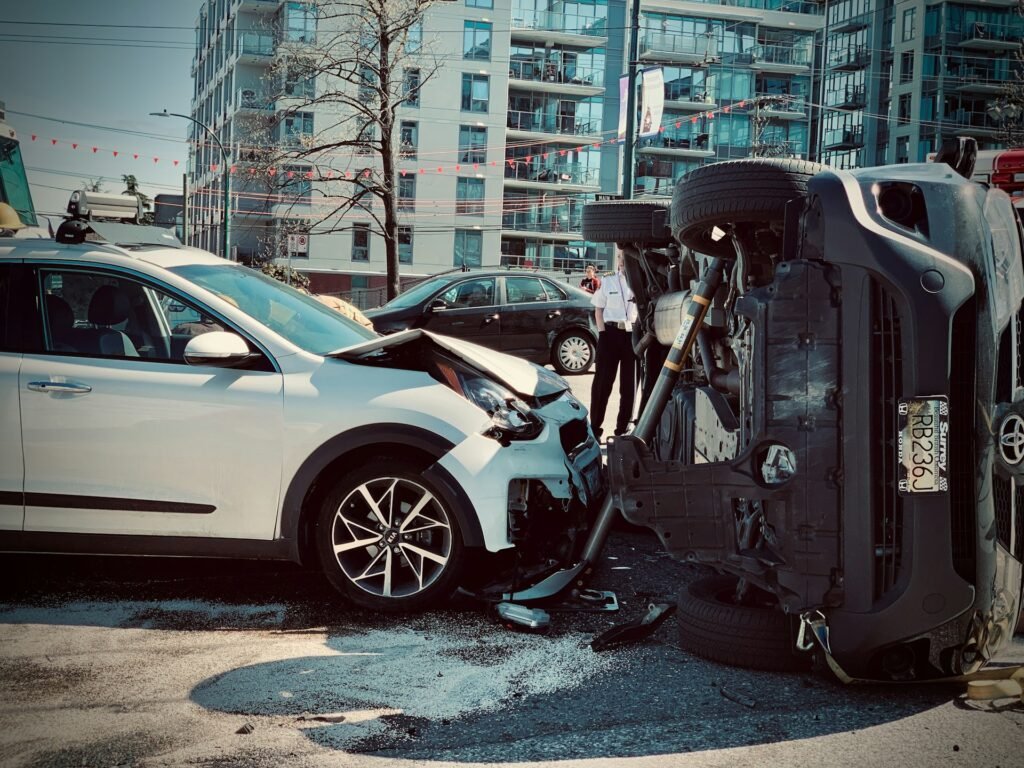

What Happens If I’m in an Accident?

Car Insurance FAQs advise taking these steps:

- Check for injuries: Ensure everyone’s safety and call emergency services if needed.

- Exchange information: Gather details from other drivers, including names, contact information, and insurance details.

- Document the scene: Take photos and note important details.

- File a police report: Some states require reporting for certain types of accidents.

- Notify your insurer: Report the accident promptly to start the claims process.

What is Gap Insurance, and Do I Need It?

Gap insurance covers the difference between what you owe on your car loan and its actual value if it is totaled. This coverage is beneficial if you have a new or leased vehicle.

Does Car Insurance FAQs Cover Theft?

Comprehensive coverage protects against theft. If your car is stolen, your insurer will compensate you based on the car’s current market value minus your deductible.

How Do I Choose the Best Car Insurance Company?

Car Insurance FAQs recommend considering these factors:

- Financial stability: Check ratings from agencies like AM Best and Moody’s.

- Customer service: Read reviews and compare claim satisfaction ratings.

- Policy options: Ensure the provider offers the coverage you need.

- Discounts and pricing: Compare quotes and available discounts.

External and Internal Resources

For more detailed insights on car insurance, visit:

- National Association of Insurance Commissioners (NAIC) for regulatory information.

- Insurance Information Institute for industry insights.

For internal guides, check out:

Final Thoughts on Car Insurance FAQs

Car Insurance FAQs provide essential information for responsible vehicle ownership. Understanding different coverage options, factors affecting rates, and cost-saving strategies can help you make informed decisions.

By staying informed, comparing quotes, and leveraging discounts, you can secure the right policy at an affordable price.

Whether you’re purchasing car insurance for the first time or updating your policy, Car Insurance FAQs ensure you have the knowledge you need.