Car Insurance Is No Longer Powered Mainly by Humans

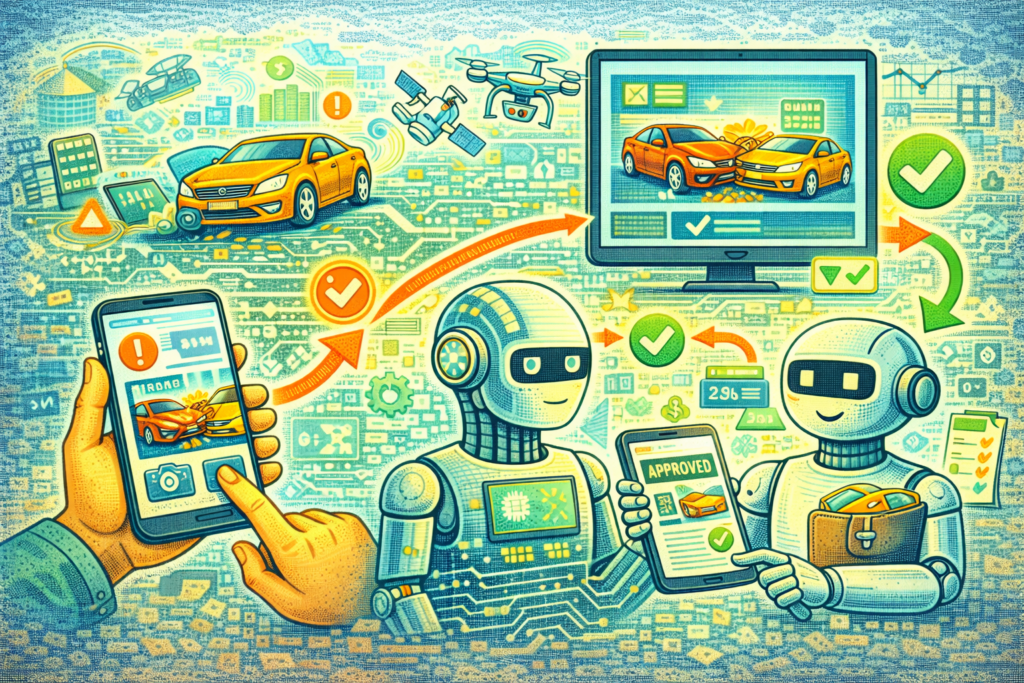

Automation in Car Insurance is driving one of the biggest transformations the industry has ever seen. In 2026, the shift isn’t just digital, it’s automated.

From instant claims approvals to pricing decisions made in seconds, automation is reshaping how insurers operate and how drivers experience coverage. Tasks that once required days, paperwork, and multiple phone calls are now handled by algorithms, real-time data, and AI-driven workflows.

According to a Harvard Business Review analysis, insurance automation is improving efficiency, reducing costs, and significantly changing customer expectations.

This in-depth guide explains how automation is transforming car insurance, where it helps drivers, where it introduces trade-offs, and what it realistically means for you in 2026 and beyond.

What Automation Means in Car Insurance (Plain English)

Automation in car insurance refers to the use of software, AI, machine learning, and connected data systems to replace or accelerate manual processes.

Processes Commonly Automated Today

- Claims intake and validation

- Damage assessment via images and sensors

- Policy pricing and underwriting

- Fraud detection

- Customer support and policy servicing

Key distinction: Automation doesn’t remove insurers—it removes friction.

Why Insurers Are Investing Heavily in Automation

Automation isn’t optional anymore, it’s competitive survival.

Core Drivers Behind Automation

- Rising claim volumes and costs

- Consumer demand for instant service

- Labor shortages in claims handling

- Explosion of vehicle and telematics data

- Pressure to reduce fraud and errors

The World Economic Forum highlights insurance automation as a key pillar of financial-services modernization in its future of finance outlook.

Takeaway: Faster, cheaper, and more accurate systems win.

1. Faster Claims Through End-to-End Automation

Claims are where automation is most visible to drivers.

How Automated Claims Work

- Accident data captured via app, sensors, or telematics

- AI reviews images and damage severity

- Coverage is verified instantly

- Smart workflows approve or escalate the claim

Example: A minor fender bender is reported via an app. Photos are uploaded, damage is assessed automatically, and payment is approved within hours.

According to McKinsey & Company research, automation can reduce claim settlement times by up to 70% for low-complexity cases.

Takeaway: Waiting days for updates is becoming the exception.

2. Smarter, Data-Driven Underwriting

Underwriting determines who gets insured—and at what price.

How Automation Changes Underwriting

- Real-time data replaces static forms

- Driving behavior is assessed continuously

- Risk profiles update dynamically

- Pricing adjusts more frequently

Data Sources Used

- Telematics and driving apps

- Vehicle sensors

- Claims history databases

- Geographic and environmental data

The Insurance Information Institute explains modern underwriting models in its industry overview.

Takeaway: Pricing is becoming more personalized and more fluid.

3. Automated Fraud Detection (Quiet but Powerful)

Fraud detection has shifted from reactive to predictive.

What Automation Does Better

- Detects unusual claim patterns

- Flags inconsistent documentation

- Cross-checks claims across databases

- Identifies organized fraud networks

The National Insurance Crime Bureau highlights advanced analytics as a critical fraud-fighting tool in its fraud prevention resources.

Takeaway: Fraud is harder to get away with, but honest claims may face extra verification.

4. Automation in Customer Service & Policy Management

Customer interactions are increasingly automated.

Common Automated Touchpoints

- Chatbots for policy questions

- Self-service portals and apps

- Automated policy changes

- Instant proof of insurance

According to Forbes Advisor research, insurers using automation report higher customer satisfaction for routine requests.

Takeaway: Convenience improves, human agents handle exceptions.

5. The Role of Telematics and Connected Cars

Automation thrives on real-time data.

What Telematics Enables

- Usage-based pricing

- Instant crash detection

- Automated emergency response

- Faster liability decisions

Example: Crash sensors automatically notify insurers and initiate claims workflows.

The National Highway Traffic Safety Administration discusses vehicle data systems in its connected vehicle guidance.

Takeaway: Cars are becoming active participants in insurance.

The Benefits of Automation for Drivers

What You Gain

- Faster claims and payouts

- Less paperwork

- More transparent pricing

- Improved fraud protection

- Easier policy management

Bottom line: Automation saves time and reduces friction.

The Trade-Offs Drivers Should Understand

Automation isn’t perfect.

Potential Downsides

- Less flexibility in edge cases

- Harder to appeal automated decisions

- Increased data collection

- More frequent pricing adjustments

The Electronic Frontier Foundation discusses data-privacy concerns related to automation in its digital rights analysis.

Takeaway: Speed sometimes comes at the cost of nuance.

How Automation Affects Your Premium

Automation can both lower and raise costs.

Why Premiums May Drop

- Reduced admin expenses

- Lower fraud losses

- More accurate risk pricing

Why Premiums May Rise

- Riskier driving detected sooner

- Frequent repricing based on behavior

- Higher repair costs revealed faster

Takeaway: Automation doesn’t guarantee cheaper insurance, it guarantees more precise insurance.

Real-Life Example: An Automated Claim in Action

After a parking-lot collision, a driver submitted photos through an insurer app. AI assessed damage, verified coverage, and approved repairs the same day.

No adjuster visits. No follow-up calls.

Lesson: Automation turns inconvenience into efficiency.

Comparison Table: Traditional vs Automated Car Insurance

| Feature | Traditional | Automated |

|---|---|---|

| Claims speed | Days/weeks | Hours/days |

| Underwriting | Static | Dynamic |

| Fraud detection | Manual | Predictive |

| Customer service | Phone-based | Digital-first |

| Data usage | Limited | Extensive |

Frequently Asked Questions

1. Is automation replacing human adjusters?

Partially, humans still handle complex cases.

2. Can I opt out of automation?

Sometimes, but it may limit discounts.

3. Is automated underwriting fair?

It reduces bias, but depends on data quality.

4. Does automation increase surveillance?

Data use is expanding, transparency matters.

5. Will automation reduce insurance costs long-term?

It may stabilize costs, not eliminate increases.

Final Thoughts

Automation is redefining car insurance, not as a distant future, but as a present reality. For drivers, it means faster claims, smarter pricing, and fewer headaches. For insurers, it means efficiency, accuracy, and survival in a competitive market.

The key for consumers is understanding the system—not fearing it. When you know how automation works, you can make better coverage choices, protect your data, and benefit from the speed it offers.

In 2026, the smartest drivers aren’t just insured, they’re informed.

If this guide helped you understand automation in car insurance, share it or explore more future-focused insurance insights on our blog.