Insurance Fraud Has Entered the AI Era

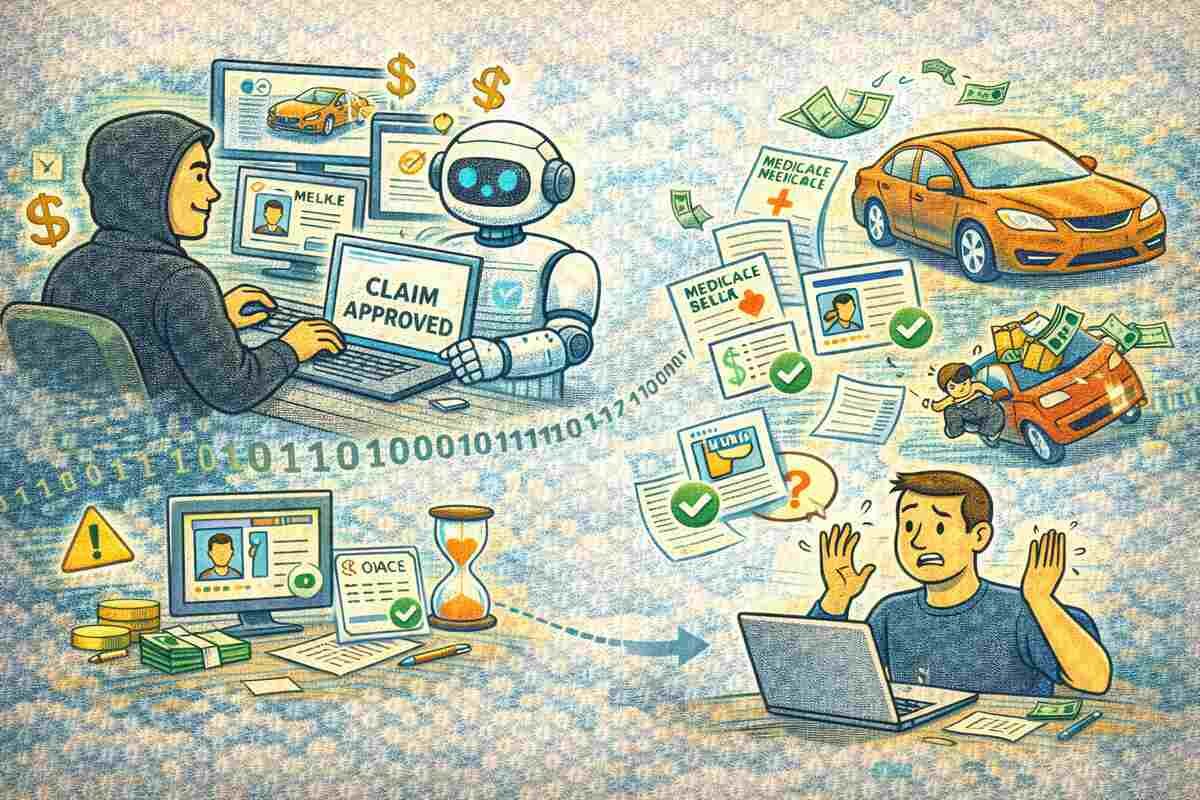

AI-Driven Fraud is rapidly reshaping car insurance in ways few drivers expect. While insurance fraud has always evolved alongside technology, in 2026 the pace of change is unprecedented. Generative AI tools can now create convincing documents, images, videos, voices, and even accident scenarios that are difficult for humans to distinguish from reality.

What once required organized criminal rings now takes little more than software access and basic prompts. As a result, insurers and drivers alike face a new generation of fraud that is faster, smarter, and harder to detect.

According to a Harvard Business Review analysis, generative AI is transforming both sides of the insurance equation, empowering fraudsters while forcing insurers to deploy equally advanced detection systems.

This guide explores how AI-driven fraud is changing car insurance, the most common emerging scams, how insurers are fighting back, and what drivers must do to protect themselves.

Why Generative AI Is a Game Changer for Insurance Fraud

Traditional fraud relied on human effort, coordination, and time. Generative AI removes many of those constraints.

What Makes AI‑Driven Fraud Different

- Realistic image and video generation

- Voice cloning and deepfake phone calls

- Automated document fabrication

- Rapid scaling of scam attempts

- Reduced need for insider knowledge

Key Insight: AI doesn’t just make fraud more effective—it makes it more accessible.

Takeaway: The barrier to entry for fraud has collapsed.

1. AI‑Generated Accident Photos & Damage Evidence

One of the fastest-growing fraud tactics involves synthetic imagery.

How the Scam Works

- Fraudsters generate realistic images of damaged vehicles

- Images are submitted as claim evidence

- Metadata is altered or stripped

- Claims appear legitimate at first glance

Generative image models can now create dents, cracked bumpers, and weather damage that look authentic—even to experienced adjusters.

Industry Insight: The National Insurance Crime Bureau has warned through recent alerts that image manipulation is becoming a dominant fraud vector.

Takeaway: “Photos as proof” is no longer sufficient on its own.

2. Deepfake Voice Calls Posing as Insurers or Adjusters

Voice cloning technology has made phone-based fraud far more dangerous.

Common Deepfake Scenarios

- Calls claiming urgent policy issues

- Fake adjusters requesting verification details

- Voicemail messages directing payments

With only seconds of recorded audio, AI systems can clone voices convincingly.

Example: A driver receives a call that sounds exactly like their insurer’s agent, requesting confirmation of personal information after an accident.

Reference: The Federal Trade Commission has highlighted AI voice impersonation scams in recent consumer warnings.

Takeaway: Voice recognition alone can no longer be trusted.

3. Synthetic Documents & Fake Repair Invoices

Generative AI excels at producing professional-looking paperwork.

Documents Now Commonly Faked

- Repair estimates

- Medical bills

- Police-style incident reports

- Tow and storage invoices

These documents often match local formats, pricing norms, and language patterns.

Why It Works: Many claims systems still rely heavily on document review rather than real-time verification.

Takeaway: Paper-based fraud has gone digital—and scalable.

4. AI‑Enhanced Staged Accident Networks

Organized fraud rings are using AI to optimize staging.

How AI Is Used

- Predicting claim approval thresholds

- Optimizing damage levels to avoid scrutiny

- Coordinating timing and locations

- Generating consistent narratives

According to McKinsey & Company research, AI enables fraud rings to test and refine scenarios rapidly.

Takeaway: Fraud has become data-driven.

5. Identity Theft Amplified by Generative AI

AI doesn’t just fake events—it fakes people.

Emerging Identity-Based Fraud

- Synthetic driver profiles

- Fake claimants with AI-generated IDs

- Blended real and fake personal data

These “synthetic identities” can persist across multiple insurers before detection.

Industry Note: The World Economic Forum has identified synthetic identity fraud as a top financial crime risk in its future risk outlook.

Takeaway: Identity verification is under pressure.

How Insurers Are Fighting Back With AI

The response to AI fraud is—unsurprisingly—more AI.

Modern Fraud Detection Tools

- Image forensics and pattern analysis

- Behavioral analytics across claims

- Telematics and vehicle sensor data

- Cross‑insurer data sharing

- Real‑time anomaly detection

Insurers now compare claims against millions of historical patterns instantly.

Insight: According to Forbes Advisor research, AI-based detection systems are reducing fraudulent payouts significantly.

Takeaway: The arms race is well underway.

What This Means for Honest Drivers

Even if you never commit fraud, you’re affected.

Indirect Impacts

- Higher premiums

- Longer claim reviews

- More documentation requests

- Increased verification steps

Fraud costs are ultimately passed on to policyholders.

Takeaway: Fraud prevention protects everyone’s wallet.

How Drivers Can Protect Themselves in 2026

You don’t need to be an expert—but you do need to be cautious.

Smart Defensive Habits

- Use official insurer apps and portals only

- Never share information via unsolicited calls

- Verify adjusters independently

- Review all claim documents carefully

- Monitor policy and credit activity

Tip: If something feels urgent and emotional, pause—that’s often a red flag.

Real‑Life Example: Avoiding an AI‑Based Scam

After an accident, a driver received a call requesting immediate payment for “processing fees.” The voice sounded legitimate, but the driver verified through the insurer’s official app.

The call was fake.

Lesson: Verification beats urgency.

Comparison Table: Traditional Fraud vs AI‑Driven Fraud

| Aspect | Traditional Fraud | AI‑Driven Fraud |

|---|---|---|

| Scale | Limited | Massive |

| Realism | Moderate | High |

| Detection | Manual | AI‑assisted |

| Speed | Slow | Instant |

| Barrier to entry | High | Low |

Frequently Asked Questions

1. Is AI fraud common yet?

It’s growing rapidly, especially in digital claims.

2. Can insurers always detect AI fraud?

Not always—but detection improves constantly.

3. Are honest claims delayed because of this?

Sometimes, due to extra verification.

4. Should drivers worry about deepfakes?

Yes—but awareness reduces risk.

5. Will premiums keep rising due to fraud?

Fraud contributes, but prevention helps stabilize costs.

Final Thoughts

AI‑driven fraud is redefining car insurance in 2026. Generative technology has empowered criminals—but it has also forced insurers to modernize, detect faster, and verify smarter.

For drivers, the best defense is awareness, verification, and patience. In a world where anything can be faked, slowing down and confirming details is the most powerful protection.

If this guide helped you understand the new fraud landscape, share it or explore more future‑focused insurance insights on our blog.